PulsePoints > September Investment & Market Update

Current Market Moving Headlines

Current Market Moving Headlines

The Gill Capital Partners investment committee meets weekly to review asset allocations, macro-economic events and manager performance. Below are a few topical items and our committee’s view on them.

China

China has dominated the global economic and market headlines over the past couple months, with the root of the concern being China’s slowing economy. China is now (by some measures) the world’s second largest economy, and markets have grown accustomed to growth rates that have routinely exceeded 7% per year, far in excess of the 2%-4% growth rates of most developed markets. What appears to be happening is an adjustment to a more reasonable growth rate, not an outright contraction. The growth slowdown has been further complicated by a series of well-publicized Chinese stock market gyrations this year. The Shanghai stock market rallied approximately 60% by June of this year, and has since fallen by about the same amount. The Chinese market is now roughly flat for the year. It has experienced a steep correction, but from our perspective, it was giving back unrealistic gains from earlier in the year. Furthermore, as we have discussed previously, unless you’re reading this from China, you probably don’t have much invested in these markets. Foreigners own just 1.5% of Chinese shares. Most foreigners own the higher quality companies that are listed on foreign exchanges; these companies have experienced much less volatility.

Our view: China is a bigger deal than Greece, and we don’t believe the market manipulation from the Chinese government is productive. However, we are now seeing high quality stocks trade at more reasonable valuations. We have a high level of confidence in our emerging market managers, and know that they are using this opportunity to build positions in the companies that they have the highest level of conviction in.

Oil

August saw oil prices slide below the psychological $40 a barrel mark briefly before rallying strongly up to $48 a barrel. This second leg down in oil prices this year came in response to increased production from Saudi Arabia & Iran, along with the slow reaction of U.S. oil inventories in the face of reduced drilling. There has been some political chatter as of late with respect to the elimination of the U.S. export ban (we are the only country in the world that cannot export oil and gas). If this were to change, it would represent a key turning point for both the production and the infrastructure side of the business.

Our view: We have seen oil cycles before, and they don’t end overnight. We do not yet view the oil & gas complex as fundamentally cheap. Many businesses within the sector are over-leveraged and unable to generate profits at these prices. We removed our high yield bond exposure in the first quarter in anticipation of this outcome. We anticipate significant M&A activity to come, along with some credit issues. We are patiently waiting for a good re-entry point to the sector.

Interest Rates

Will the Federal Reserve raise interest rates? When will they raise interest rates? What happens when they do?

Our view: Realistically, the Federal Reserve should have raised interest rates months ago. Our economy remains fundamentally sound, and to keep the monetary policy at crisis levels does not make sense. We believe the Federal Reserve will “test the waters” by raising interest rates this year between September and December, and then will increase them methodically and slowly until they get back to a “normal” level somewhere between 2% and 3%. We do believe this will create some volatility as markets adjust. Our belief is that this would be a very healthy move, and that markets will interpret it as such after some initial volatility. We have been very thoughtful in how we design fixed income portfolios around this eventuality. We prefer the use of individual bonds that we are able to buy directly, and also utilize fixed income managers that have the ability to generate positive returns as interest rates move higher.

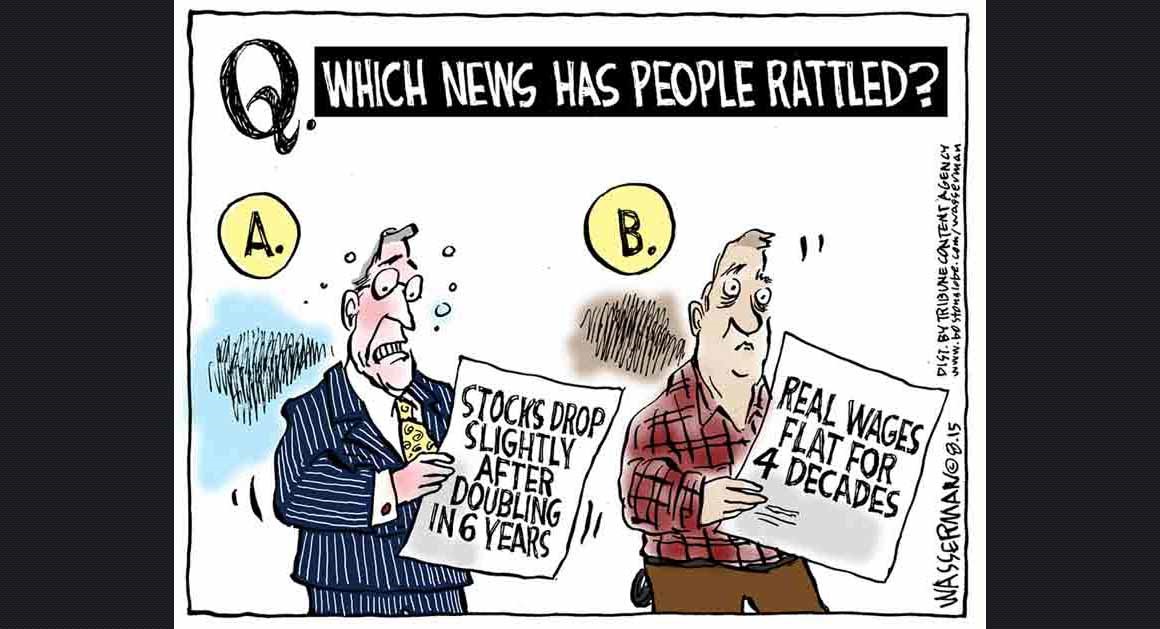

Market Volatility

It has been a long time since we have seen a 10% correction in equities, which is actually a normal and healthy part of market cycles. That being said, it can still be disconcerting to watch.

Our view: We continue to believe this is a long overdue correction and stay true to the following: maintain perspective, don’t let your emotions drive bad decision making, and rebalance.

Please let us know if you have any questions or concerns about this report, if there have been changes in your financial circumstances, or if we can provide assistance with any other financial matters including education, taxes, insurance, or estate needs.