Gill Capital Partners Late-March 2022 Update

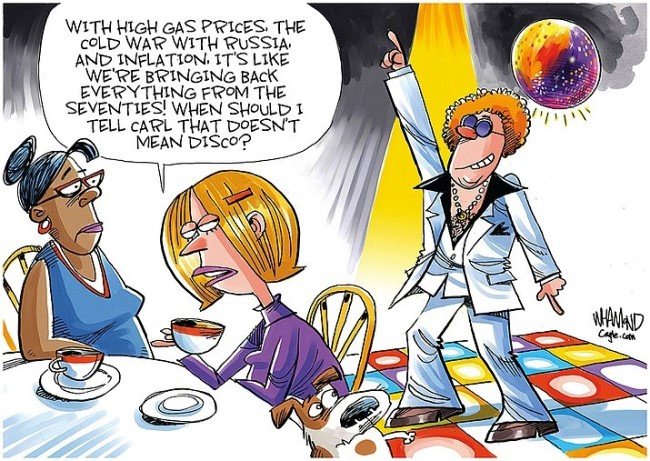

Well, March has been interesting… so much for 2022 bringing a return to normal. While finding humor amidst the chaos can be cathartic, we are very cognizant of the awful situation in Ukraine and the pain and suffering currently being experienced there. Once again, there is no shortage of topics to review, including an update on the war in Ukraine and how it is impacting global economies and markets, an update on the Federal Reserve and their recent rate increase, and a general update on the markets, which have largely been able to shrug off an onslaught of bad news. We will get into these issues in more detail and, of course, provide our views on them.

Ukraine Update

The seemingly improbable worst-case scenario continues to unfold in horrific fashion with Putin determined to pummel Ukraine into submission and install a pro-Russia government. The Ukrainians, by all accounts, are putting up an epic battle defending their country. However, the damages and the losses continue to pile up on both sides without a clear endgame in sight, and the world is fearful of further military escalation from what may become a desperate Putin. Sanctions against Russia, its elites, and its politicians have continued to ratchet up and are ravaging the Russian economy and driving up commodity prices globally. The Russian stock market opened for limited trading for a small number of companies this week for the first time in a month, though there were significant restrictions on selling. The Russian government has pledged to support stock prices with up to $10 billion. The Russian Index finished up 4% but remains down more than 30% since the war began. Oil and commodity prices are where the real impact has been as we continue to see significantly higher prices across much of the commodity space.

Our view – While the Russian stock market is a very small component of global equity markets, Russia is one of the world’s largest exporters of energy and agricultural commodities, and, as such, the sanctions and disruptions are having a much larger impact on those markets. Oil is currently bouncing around above $110/barrel, and many agricultural commodities such as wheat and fertilizer have pushed to all-time highs. These moves higher in commodity prices will continue to put pressure on consumers and businesses in the weeks and months to come, aggravating an already problematic inflation situation. Prior to the onset of the war in Ukraine, most were anticipating inflationary pressures due to the pandemic to moderate in the back half of 2022 as supply chain issues resolved themselves. Now that narrative is very uncertain, and inflationary pressures could certainly persist. As we have mentioned previously, Europe will be more severely impacted than the United States and recession is a real possibility for Europe. At this time, we continue to believe that the U.S. will avoid a recession, but the risks are increasing as higher commodity prices, combined with higher interest rates and the absence of Federal stimulus, will slow growth in the U.S.

Inflation, Interest Rates & the Federal Reserve

Just last week in a widely anticipated move, the Federal Reserve raised its benchmark federal funds rate by a quarter percentage point, the first rate increase since 2018. Perhaps more importantly, officials signaled that they hope to raise the rate to nearly 2% by the end of this year and 2.75% by the end of 2023, slightly higher than their previous projection. Furthermore, Mr. Powell said that the Fed could finalize a plan to shrink its $9 trillion balance sheet at its next meeting in May and begin implementing it shortly thereafter. The Federal Reserve laid the groundwork for larger rate increases of up to a half point at subsequent meetings. Interest rates on bonds and other instruments moved higher following the news, pricing in a more aggressive posture by the Federal Reserve.

Our view – Following the recent selloff in the bond market (rates up = bond prices down), the bond market is now in near perfect alignment with the Federal Reserve’s forecast for interest rates. With the bond market now fully pricing in a more aggressive Federal Reserve, we believe that rates, particularly short-term rates, may be at or close to near-term highs. If anything, irrespective of the aggravated inflation environment, we feel the Fed’s forecast may be a bit too aggressive given the backdrop and economic risks that are present today. The Fed is likely to take its cues from the stock market, which will tell them when enough is enough, and that is likely to happen well before their forecasted terminal rate. We do not feel that raising interest rates is a silver bullet for the type of inflation we are seeing today. Higher interest rates are not going to fix the commodity price, supply side inflation resulting from the war in Ukraine. Though they can help pop asset bubbles and cool the economy, they are fairly useless in the face of supply-driven inflation problems, and the Fed knows this. The Fed is doing the right thing, but we anticipate that the actual pace of rate increases falls short of their forecast, and therefore, bonds might actually look surprisingly attractive at the moment.

Market Update

This has been a tough market, and as we mentioned in our last update, investors need to be prepared for a bumpy road. As of this writing, both the S&P 500 and the Barclays Aggregate Bond Index are down roughly 6% for the year. Certain equities, such as tech and small caps, are down significantly more than the S&P. However, given the backdrop (war, inflation, rising interest rates, covid, etc.), one might expect a much steeper correction. So why are stocks holding up relatively well given the very difficult environment?

Our view – Part of the answer lies with a Federal Reserve that has prepped and guided this market for a very long time for the eventuality of rising rates. It is not a surprise. In fact, the Federal Reserve announced that they will likely be getting more aggressive at their next meeting and stocks went up. No, the market does not like higher rates (quite the opposite, actually), but the market has weighed the outlook and feels that a credible Fed is a strong Fed, and higher rates are better than entrenched inflation. Furthermore, earnings have continued to be strong, with a very healthy consumer so far shrugging off inflation and an incredibly strong labor market providing high paying jobs. Yes, there are concerns that persistent and increasing inflation will begin to chip away at the consumer, but so far consumers and household spending have held up well. This is a market that is rife with reasons to go down but continues to stubbornly maintain its ground.

As always, please let us know if you have any question or concerns, or if we can provide assistance with any other financial planning matters including education, taxes, insurance or estate needs.