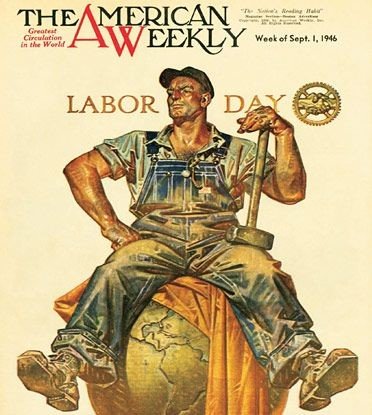

Gill Capital Partners Labor Day 2022 Update

It is hard to believe that Labor Day is here and summer is nearly over. While the formal end of summer is not until the autumnal equinox on September 22nd, Labor Day marks the end of summer for many with the return to school, football season, and cooler days. Markets have seen a resumption of volatility as of late, following a calmer, more optimistic early summer rally. We will get into all of that and more, but first, a few interesting facts about Labor Day:

For those of you who do not know, Labor Day celebrates the contributions of the millions of hardworking Americans that labor every day.

Labor Day is a U.S. federal holiday. It is celebrated annually on the first Monday of September. Our Canadian neighbors to the north are credited with the origination of the holiday, having adopted it nearly 10 years prior to the U.S.

Oregon was the first U.S. state to make Labor Day a legal holiday in 1887.

Labor Day marks the official end of hot dog season. According to the National Hot Dog & Sausage Council (yes, that is a real thing), hot dog season starts on Memorial Day and ends on Labor Day.

Federal Reserve, Inflation, Interest Rates & Markets

Each summer, the central bank holds their annual symposium in Jackson Hole, Wyoming. Market pundits and analysts look to this meeting to gauge whether to expect any potential changes to monetary policy. This year, economists and analysts were paying particular attention to this meeting. While many investors were hopeful that the Fed would soften their stance toward higher interest rates, Fed Chairman Jerome Powell and other Federal Reserve governors recalibrated market expectations by making it clear that fighting inflation is the Federal Reserve’s top priority. They also made it clear that even if doing so results in some “pain” for investors, the central bank will continue raising interest rates and shrinking its balance sheet “for some time.” The S&P 500 has dropped in response to the renewed, more “hawkish” tone, and interest rates have once again moved higher.

Our view – This wasn’t the news that markets were hoping for following a more sanguine speech by Chairman Powell after the last Fed meeting. During the summer equity rally, investors began to expect that the Federal Reserve would pivot in the not-too-distant future to interest rate cuts due to rising recession fears and the potential for slowing inflation. Powell’s speech from Jackson Hole quickly changed that view, causing interest rates to spike and stocks to fall. Another message from the Federal Reserve was clear; they did not appreciate the fact that markets had begun discounting their future moves.

As it relates to inflation, we continue to see signs that inflation is cooling. Below are a few data points we are watching closely:

Energy prices, particularly crude oil, have continued to move lower. This is one of the largest single components in the Consumer Price Index (CPI).

Producer prices, a measure of inflation from the perspective of producers, posted its first monthly drop since early 2020.

The NAHB housing market index, which tracks residential housing sales, decreased again in August, marking the eighth consecutive monthly decline and falling to its lowest level since March of 2020. Prices have remained elevated but are likely to follow sales volume on a delayed basis.

We continue to believe that inflation is cooling, but the proof is going to be in the pudding. The Federal Reserve is going to need to see material declines in the CPI before they take their foot off the gas pedal on interest rates. At the end of the day, not a whole lot has changed from where we were earlier in the summer. Bond and stock markets are fully pricing in the anticipated Federal Reserve interest rate hikes and are largely in agreement with the Fed’s own forecasts for where interest rates are going. As mentioned above, we do believe that inflation is cooling. We will get another CPI report on September 13th, right before the next Federal Reserve meeting, where they are sure to raise interest rates again. We will get more information about their thinking following that meeting.

A positive by-product of higher rates is the ability to earn more in interest on fixed income products. From money markets to bonds, the increase in rates is providing an opportunity for higher returns in this asset class. We have taken this chance to put cash to work and generate more income for portfolios and will continue to do so as cash becomes available. We will also continue to rebalance portfolios amidst this volatility to maintain alignment with our clients’ objectives and to provide future tax benefits where possible.

Investors need to expect the volatility will continue (up & down) until the Federal Reserve sees a meaningful cooling of inflation. As we saw earlier this summer, markets will move quickly and aggressively higher with any good news.

Enjoy your Labor Day holiday! We are always here if you want to talk, commiserate, or grab a hot dog.

As always, please let us know if you have any questions or concerns, or if we can provide assistance with any other financial planning matters including education, taxes, insurance or estate needs.