Gill Capital Partners December 2023 Holiday Update

First and foremost, the team at Gill Capital Partners would like to wish our friends, clients and partners very happy holidays and a peaceful and healthy new year. We are incredibly thankful for all of you and feel fortunate for the amazing relationships we have with our clients, friends, partners, and colleagues.

As we approach the end of the year, we are also thankful for the improved market environment, which has been driven by a steadily improving inflation picture and an economy that has been able to maintain momentum in the face of significantly higher interest rates. The Federal Reserve held its final meeting of the year, and we received updates on inflation and jobs. At least for the time being, the market likes what it is seeing and has rewarded investors with a very healthy Santa Claus rally. We will address these in more detail below and, of course, provide our view on them.

Inflation and Jobs

The two most important economic data points right now are inflation and jobs, and we received a monthly update on both this past week.

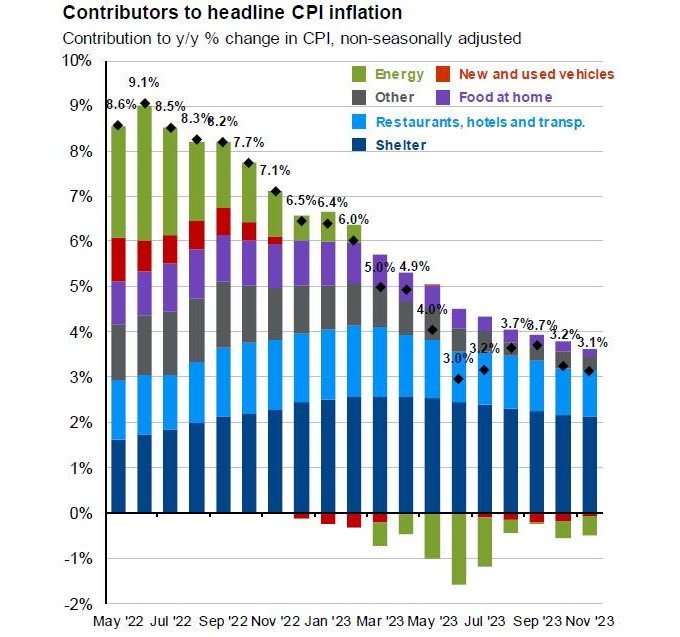

Inflation – The monthly report on consumer prices (CPI) came out this week, and it showed that consumer prices rose 3.1% from a year ago and were up 0.1% for the month. Core CPI, which excludes food and energy prices, increased 0.3% for the month and 4% from a year ago. A 2.3% drop in energy prices was the single largest downward contributor for the month. Prices on a broad range of goods and services edged higher in November, though they were mostly in line with expectations. These numbers, as a whole, were also largely in line with economist expectations for the month.

Our view – From a big-picture perspective, this was a pretty good number void of any big surprises that signals inflation continues to move in the right direction. We still have a ways to go before we hit the Federal Reserve’s target of 2%, but we are moving in the right direction. The single largest downward pressure on inflation right now is energy, which has been in free fall for the past couple of months. Gasoline prices, the unofficial arbiter of the national mood, are 9% cheaper than a year ago, and this is felt directly and immediately by most consumers. Overall, it is a much better picture now than a year ago; in fact, there is deflation (falling prices) in 10 categories, and food inflation has moderated to just 1.7%. There is really just one problem area that remains stubborn and sticky: rent. Housing, which includes rent, increased 5.2% over last year and now makes up the lion’s share of the total inflation picture. It is unclear if or when the housing component of inflation will moderate. We are very pleased to see inflation moving in the right direction and in the 3% range as opposed to the 8-9% range we saw a year and a half ago.

Jobs – We received the monthly non-farm payroll jobs report this past week. Payrolls rose by 199,000 in the month of November, slightly better than the 190,000 estimated and ahead of the October gain of 150,000. Additionally, the report showed that the unemployment rate declined to 3.7%, which was stronger than the expectation of 3.9%. Health care was the biggest source of new hiring, adding 77,000 new jobs, along with government (49,000) and manufacturing (28,000).

Our view – Job creation in the month of November was slightly better than expected, which is a testament to the momentum in this economy. Many economists were anticipating a slower economic environment to manifest itself in a weakening labor market, but that has not been the case; in fact, we’ve seen quite the opposite. There has certainly been some softening in the labor market over the past year, with job openings continuing to moderate and workers voluntarily leaving jobs. This has been welcomed by employers trying to find workers. This report, while continuing to show a resilient job market, also provided the Federal Reserve evidence that the labor market is becoming more balanced.

Federal Reserve and Interest Rates

On Wednesday, The Federal Reserve announced that it would hold the Fed Funds rate steady for the third straight time and indicated that multiple rate cuts are coming in 2024 and beyond. Policy members voted unanimously to keep the benchmark overnight borrowing rate in a targeted range between 5.25% – 5.5%. They also penciled in at least three rate cuts in 2024. Markets had widely anticipated the decision to stay put but were less certain as to how ambitious the FOMC might be regarding policy easing. Following the decision, markets jumped over 1% and interest rates dropped, with the 10-Year Treasury approaching 4%.

Our view – The market appears to be getting greedy, pricing in even more rate cuts than the Fed. The Fed is forecasting three rate cuts in 2024, four in 2025, and three more in 2026, taking the fed funds rate down to 2%-2.25%, in line with their long-term target. Markets, however, followed up the meeting by pricing in even more aggressive rate cuts, as shown in the chart below. Markets are currently pricing in six 0.25% rate cuts in 2024, double the FOMC’s indicated path. From a historical perspective, the Fed usually ends up cutting rates aggressively to ward of economic issues, so the markets may be right.

Equity markets have been moving methodically higher over the past 45 days, largely in anticipation of a Fed would signal an end to rate hikes and the probability of lower rates to come. Many of the most interest rate sensitive areas, including small-cap stocks, biotechnology, and REITs, have seen the largest moves, but this has certainly been a case where a rising tide is lifting all ships. We welcome the year-end rally, as we are sure all of you do, after a tough couple of years of market returns.

We hope everyone has a wonderful holiday season. Stay healthy and safe!

As always, please let us know if you have any question or concerns, or if we can provide assistance with any other financial planning matters including education, taxes