Gill Capital Partners February 2025 Market Update

The start to 2025 has been anything but quiet. The transition to Donald Trump’s new administration has taken center stage with a flurry of executive orders, to include tariffs on hundreds of billions of dollars in imports from Canada, Mexico and China. Competing for the spotlight was China’s release of its own AI tool, DeepSeek, which caught the market by surprise. Finally, there was a Federal Reserve meeting last week, which almost slipped under the radar, overshadowed by larger headlines. Let’s jump right in, starting with DeepSeek.

DeepSeek

The Chinese AI startup DeepSeek recently released its AI chatbot tool. The release surprised many, as the tool appeared relatively close in quality and performance to its U.S. AI peers but was reportedly created at a fraction of the cost. DeepSeek claims to have been built on a tight development budget of only $6 million. Furthermore, DeepSeek has been released with so-called “open-source architecture,” meaning researchers and developers can freely experiment with, modify and deploy the model without the restrictions of the big-name proprietary U.S. alternatives. Moreover, they were believed to have accomplished this without relying on the highly advanced Nvidia chips that were once considered essential for developing such technology. Finally, DeepSeek is free to use, compared to many of the U.S. based models that charge between $20-$200/month. The tool has quickly risen to the top of the download charts and struck fear amongst the U.S. based AI community.

Our view – Let’s start with why this matters. AI is a transformational technology that will have widespread global impact, shaping areas such as automation, news creation, military strategy, and more. Due to its far reaching geo-political ramifications, AI is the modern-day space-race, and this might have been the “Sputnik” moment. Global governments are racing to ensure they are at the forefront of the most advanced AI tools. Until the release of DeepSeek, the U.S. was thought to have a significant lead in the AI world, with the big names pouring billions into the development of proprietary technology. Then a little Chinese startup emerged and developed a comparable tool for just $6 million without relying on high-end Nvidia chips. Combined with its open-source nature and free accessibility, this has sent shockwaves through the U.S. tech industry, which, as shown below, has been investing billions into AI.

If this Chinese startup can create a comparable, free, open-sourced product for a mere $6 million, some of the big tech companies will likely need to rethink their capital spend on AI.

Tariffs

President Trump said Saturday that the U.S. will levy 25% import tariffs on goods from Mexico and Canada, with Canadian energy products facing a 10% tariff. He also stated that the U.S. will impose an extra 10% tariff on imports from China. The tariffs will take effect on Tuesday, February 4th. Canada and Mexico have already announced retaliatory tariffs. This situation is rapidly developing and, as of this writing, the Mexican and the Canadian tariffs have been delayed for 30 days as negotiations continue.

Our view – This is a highly complex and fast-moving situation, and the outcomes are highly uncertain. It appears that the tariffs are being used as a negotiating tool. Economists have concerns that tariffs will increase prices to American individuals and businesses on a host of items including cars, gas, smartphones, and lumber, just to name a few. During Trump’s first term, American firms had the opportunity to apply for exemptions from tariffs; it is unclear if there will be a similar process this time. What should we expect moving forward? Lots of uncertainty, as this is an extremely fluid situation. President Trump commented that this may cause “some pain” for Americans, but Wall Street generally believes that this is part of a negotiating process, and tariffs may not last long. Investors should be prepared for increased market volatility until such time that we have better clarity on the situation and its long-term impacts.

Federal Reserve Update

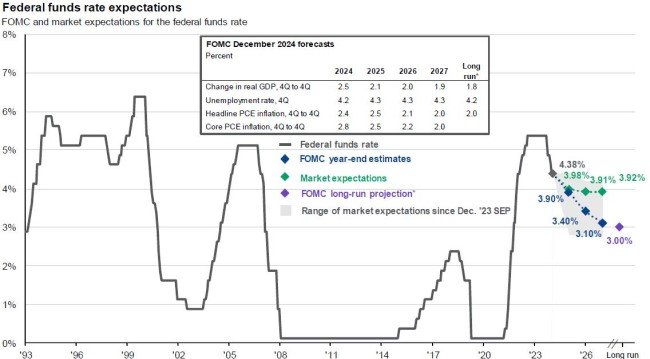

In its first meeting of the year, the Federal Reserve left interest rates unchanged between 4.25%-4.50%. This decision reversed the recent trend of easing rates, which had seen three straight cuts since September 2024. This move was widely anticipated by economists and markets. The post-meeting statement offered a few clues about the reasoning behind the decision to hold rates steady. Powell offered a somewhat more optimistic view on the labor market while dropping a key reference from the December statement that inflation “has made progress toward” the Fed’s 2% inflation goal. “The unemployment rate has stabilized at a low level in recent months, and labor market conditions remain solid… inflation remains somewhat elevated.” The combination of a stronger labor market, stubborn inflation and above trend economic expansion are providing less incentive for the Fed to ease policy.

Our view – Again, this was very much anticipated across capital markets. Inflation has moderated substantially but is still above the Fed’s target of 2%. Fed officials are taking a wait and see approach, as they want to allow previous cuts to work their way through the economy before providing more easing. This was the first Federal Reserve meeting during the new administration and markets were eager to hear how the Federal Reserve would react to President Trump’s statement that he would “demand” that interest rates be lowered “immediately,” signaling a potentially contentious relationship with Federal Reserve policymakers. For now, however, as illustrated in the chart below, the market is not anticipating significantly lower interest rates in the near future.

Conclusions & Portfolio Updates – Markets and investors are being thrown a lot of new information very quickly, much of which lacks clarity, from AI to the Fed to the new administration’s policies. Investors should be prepared for increased volatility. As we said last month, we are rebalancing portfolios to align with a slightly more defensive posture; we feel this is warranted given some of the uncertainty outlined above and the fact that markets are at or near all-time highs. If you wish to discuss this further, we are always available.

As always, please let us know if you have any questions or concerns, or if we can provide assistance with any other financial planning matters including education, taxes, insurance or estate needs.