The Capital Difference: Don’t Overlook Tax Implications of Investing

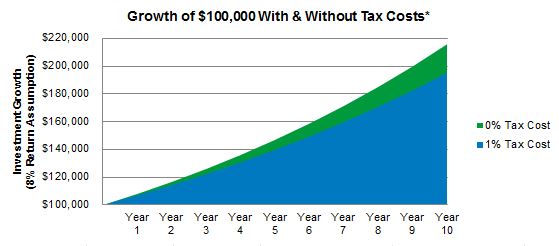

Many investors don’t think about the tax implications of their investment portfolio until April 15th. We currently live in a world of high taxes and low yields, so every move counts. See below for a graph from Blackrock that shows the impact of a 1% annual tax “cost” on a $100,000 portfolio. Over 10 years, assuming an 8% annualized growth rate, the investor would have a $20,000 differential in return with a more tax efficient portfolio.

For more year end portfolio ideas to improve tax efficiency, take a look at the following information Portfolio Moves to Consider Before December.