Pulse Points > April Investments & Market Update

Gill Capital Partners April 2017 Market Commentary

“The individual investor should act consistently as an investor and not as a speculator.” – Benjamin Graham

Q1 2017 Market Review

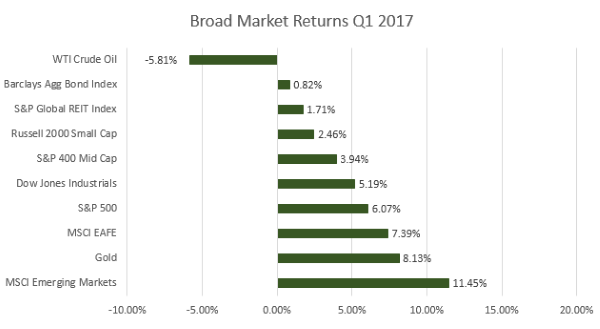

The first quarter of 2017 was a very positive quarter, particularly for diversified portfolios. The “Trump Rally” continued throughout the quarter and acted as a tailwind for global equity indices. As shown below, emerging market (EM) and international equities paced the gains in the first quarter, with EM equities up over 11% on a total return basis (more on this below). U.S. equities were up between 2% and 6% for the quarter, driven by newfound prospects for economic growth that emerged after the election. Bonds were largely flat for the quarter as interest rates bounced in tight range between 2.3% and 2.6% on the 10-year U.S. Treasury. Asset allocation and diversification worked well in the first quarter. It was also a good quarter for active management, as the majority of our actively managed mutual funds showed significant outperformance relative to their benchmarks.

What are we talking about at Gill Capital Partners?

Our Investment Committee meets weekly to review portfolio allocations, macro-economic events and managers. Below are some areas in which we have been particularly focused, assessing changes to the macro-landscape and determining whether these might drive changes in client portfolios.

What is driving the move higher in emerging markets?

Emerging market equities has been the best performing asset class to start the year, with the MSCI Emerging Markets Index up 11.45% so far in 2017. What is behind the move, and can it continue?

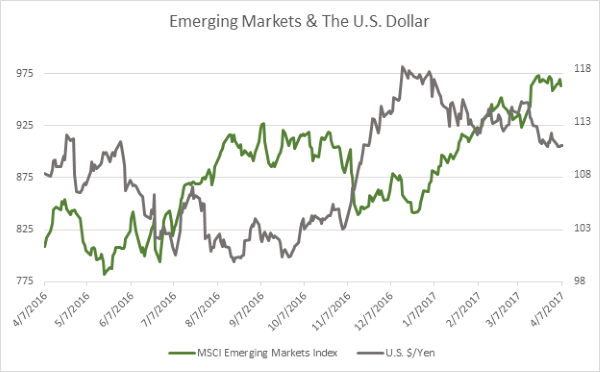

Our View – Emerging market equities have severely underperformed for years relative to U.S. stocks, as a strengthening U.S. Dollar and sluggish economic growth have continued to depress prices. We have maintained a position in emerging markets as part of our overall asset allocation, despite the underperformance, with the belief that emerging market equities play an important role in building diverse portfolios and they are capable of generating significant returns. Below is a chart of the MSCI Emerging Markets Index vs. the U.S. Dollar over the past year. As you can see, there is a very strong inverse relationship between emerging markets and the U.S. dollar. Much of the corporate debt in these countries is denominated in U.S. dollars, and that debt becomes more expensive as the dollar strengthens. So far in 2017, we have seen the U.S. dollar weaken, which, combined with accelerating economic growth and very attractive relative valuations, has created a tail wind for emerging market equities. Given the fact that emerging market equities have been essentially flat over the past decade, combined with improving fundamentals, we continue to have an optimistic view with respect to the return potential for emerging market equities over the next few years, and maintain appropriate target allocations within portfolios.

Please let us know if you have any questions or concerns about this report, or if there have been any changes in your financial circumstances including education, taxes, insurance or estate needs.