Pulse Points > April Investments & Market Update:

Gill Capital Partners April 2018 Commentary

“Inflation is when you pay fifteen dollars for the ten-dollar haircut you used to get for five dollars when you had hair.” – Sam Ewing

Q1 2018 Market Review

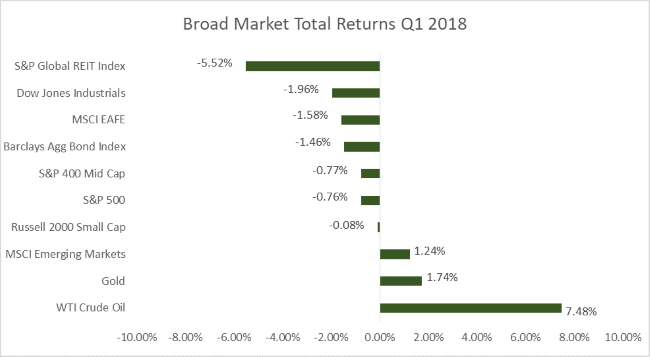

The first quarter of 2018 saw volatility return to the global capital markets after a prolonged period of steady positive returns for most asset classes. As outlined last month, concerns over higher inflation initially spooked the markets early in the quarter, driving bond yields up and stocks down. Concerns related to global trade wars, accompanied by Donald Trump’s targeted attacks on Amazon, further exacerbated investors’ anxiety. As shown in the chart below, most U.S. equities were down between 1% and 2% by the end of the quarter, with REITs posting the worst performance given their sensitivity to interest rates. Emerging market equities were the only equity asset class to post positive returns for the quarter. Commodities posted the strongest returns, with help from a dollar that continued to weaken on the prospect of a higher budget deficit following the passage of tax cuts and spending bills.

What are we talking about at Gill Capital Partners?

Our Investment Committee meets weekly to review portfolio allocations, macro-economic events and managers. Below are some areas in which we have been particularly focused, assessing changes to the macro-landscape and determining whether these might drive changes in client portfolios.

Current Market Overview – Opposing Forces

Following a very good year for returns in 2017, the return of volatility, accompanied by heightened political risk, has many questioning if the best returns are behind us or if this expansion can continue.

Our View – We currently see opposing forces at work driving the wild intra-day swings we have been experiencing over the past couple of months. The positive forces we see are as follows:

Economic growth – We are seeing coordinated global economic growth that is strengthening. This level of broad global economic growth has not been seen for quite some time and will continue to be supported further by the recent U.S. tax cuts.

Valuations –As reflected in the chart below (courtesy of JPMorgan), valuations have come down significantly from their recent peak. Increasing projected earnings, combined with the recent pull-back in prices, are pushing equity valuations back to their long-term average. While they are not historically cheap, they are also not necessarily expensive either. We will call this a modest positive.

The significant negative forces we currently see at work are as follows:

Political Risk – The political and geo-political environment has seemingly devolved on multiple fronts and does pose headline risk to the markets as a whole.

Rising Interest Rates & The Federal Reserve – For so many years, investors and global economies have had the Federal Reserve and other central banks on their side. With the Federal Reserve intent on pushing rates higher and reducing the size of its balance sheet, it is hard to say that this is still the case. So far, interest rates have risen methodically and are still at historically low levels, but as they continue to rise, and if they rise at a more aggressive pace, this will continue to pressure markets.

These opposing forces are creating a confusing environment for many investors. We continue to believe that the fundamentals of economic growth, now aided by better valuations and the prospect for strengthening corporate earnings, continues to foster an environment where equities can generate positive returns. We view the negative political headlines largely as noise that continues to get louder, but is not a significant enough threat at the moment to override fundamentals. We see greater risk in rising interest rates and the unknown outcomes generated from the unwinding of the Federal Reserve balance sheet than the mind-boggling tweets that are currently making headlines.

Please let us know if you have any questions or concerns about this report, or if there have been any changes in your financial circumstances including education, taxes, insurance or estate needs.