Pulse Points > June Investments & Market Update

Gill Capital Partners June 2017 Market Commentary

What are we talking about at Gill Capital Partners?

Our Investment Committee meets weekly to review portfolio allocations, macro-economic events and investment managers. Below are topics that are top of mind within the Committee.

Interest Rates and the Federal Reserve:

In a widely anticipated move, the Federal Reserve voted to increase the overnight lending rate by a quarter point last week to a target range of 1.00%-1.25%, marking the third increase in six months. They also maintained their outlook for one more hike in 2017. Perhaps more significantly, they indicated that they intend to begin shrinking their balance sheet, stating, “The committee currently expects to begin implementing a balance sheet normalization program this year, providing that the economy evolves broadly as anticipated.” Balance sheet normalization refers to the reduction of the Federal Reserve’s bond purchase program, which was implemented to help keep interest rates low in an effort to stimulate the economy.

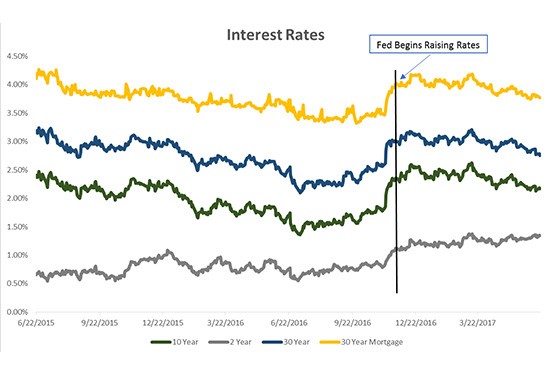

How have the actions and statements of the Federal Reserve impacted the bond market and interest rates? The chart below shows U.S. Treasury rates (2-, 10-, and 30-year), along with 30-year conventional mortgage rates over the past two years.

While short-term rates (2-year) have increased methodically over the past year, longer-term rates have actually dropped. Why are interest rates dropping if the Federal Reserve is increasing the target rate and telling the market they will begin balance sheet normalization this year?

Our View:

Surely this must be a misunderstanding, right? Everyone knows that interest rates are rising. So what is happening? Quite simply, the bond market is not yet buying the case for materially higher rates. The recent release of economic reports shows slower than anticipated economic growth, as GDP, retail sales, housing, and industrial production all trailed estimates. The reflation trade that had roots in tax reform and deregulation is in jeopardy at the moment as the Trump administration is too busy putting out fires to focus on policy. Finally, inflation remains stubbornly below the Federal Reserve’s 2% mandate. To be clear, we are not seeing any signs of a recession; in fact the economy is quite healthy. However, meaningfully higher interest rates will require a faster pace of economic growth than we are seeing now, and the bond market is in “wait and see” mode at the moment.

Stock Market Update

With U.S. stocks at or near all-time highs, many are wrestling with how much higher the equity markets can go, and if a pullback or a correction is coming.

Our View:

First, we do not believe in market timing. Rather, we build diverse portfolios of assets that can grow over long periods of time commensurate with our client’s goals. Corrections and pullbacks are a natural part of the investment cycle. We also know that over long enough periods of time, equity investors are rewarded for taking incremental risk. We don’t know when the next correction or pullback is coming in any market, but having discipline and a plan is what separates investors from speculators. Regarding the current environment, we certainly recognize where the markets are and the geo-political risks that exist. However, we also recognize that there is much about the current environment that continues to be supportive of equity ownership. In fact, if one could draw up a favorable environment for stocks it would have the following characteristics:

- Economic growth that is not too fast or to slow (Check)

- Low inflation (Check)

- Interest rates that are low and not competitive with stock prices (Check)

- Corporate earnings growth that is not too fast or too slow (Check)

- High household net worth (Check)

- High level of skepticism (Check)

While there is certainly a case to be made that the markets are due for a healthy pullback, there is also a foundational case for why stocks can continue to move higher from here. We can’t predict what will happen, or when, so we continue to build and maintain thoughtful, well-diversified portfolios.

As always, please let us know if you have any question or concerns, or if we can provide assistance with any other financial planning matters including education, taxes, insurance or estate needs.