PulsePoints > September Investments & Market Update

September Investment & Market Commentary

“When an investor focuses on short-term investments, he or she is observing the variability of the portfolio, not the returns - in short, being fooled by randomness.” -Nassim Nicholas Taleb

Market Update

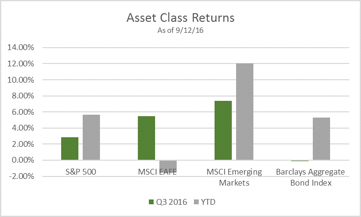

As fall approaches, it appears that volatility has re-emerged as markets have pulled back from their recent highs over the past few days. Interest rates have finally moved modestly higher after being pinned down for the past few months. The market continues to wrestle with the prospect of higher rates and a stable, but slow growth economy. As of this writing, most major U.S. equity indices are in positive territory for the year, with the S&P 500 up just over 5%. International equities, as measured by the MSCI EAFE index, are currently down nearly 2% for the year, but are having a very strong quarter. Emerging markets are now leading for the year, up 12%. U.S. bond returns are flat for the quarter and up just over 5% for the year.

Below are a few topics that our Investment Committee has been discussing recently:

Equity Valuations – Income is King

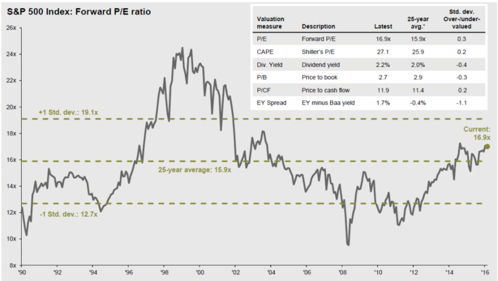

We have been paying close attention to valuation (both nominally and relative to historical averages). The below chart, courtesy of J.P. Morgan, illustrates the current forward P/E ratio of the S&P 500 (the price of all stocks in the index divided by their anticipated earnings) relative to its long term average. As you can see, this market at 16.9x forward P/E is slightly above the long term average of 15.9x.

Our view:

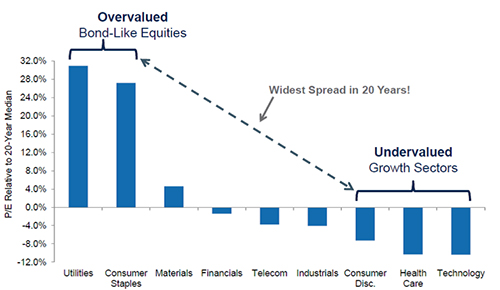

Based on the above, we believe that this market is fairly valued from an aggregate perspective. Some might say that that valuations are stretched, and while that may be true for specific stocks or sectors, from a high level we do not believe that this market is dramatically overvalued, nor do we believe that a correction based upon valuation is imminent. We do believe that certain areas of the market are overvalued, namely the more defensive sectors, which have historically generated higher levels of income. There has been a dramatic and insatiable search amongst investors looking for income over the past several quarters, and this has led to rapid appreciation in certain areas such as utilities, high dividend equities and REITs. The rush into these areas has pushed these sectors and individual securities to an area of overvaluation, and in some situations dramatically so, as shown below.

While investors have been pouring money into income-producing sectors, they have shunned others such as technology, financials, healthcare, and consumer discretionary. In fact, many of the aforementioned sectors are now trading at moderate to deep valuation discounts as compared to their historical averages. We believe it is these areas that will lead from a performance standpoint going forward.

International Equities

As shown in the Asset Class Returns chart at the beginning of this piece, international equities are enjoying a very strong quarter, far outpacing bonds and their U.S. equity counterparts. What is driving this outperformance, and can it continue?

Our view:

International equities, and particularly emerging market equities, have consistently underperformed the U.S. for the past several years. It has been painful at times to continue to hold international positions that have been a drag on performance. However, we have maintained our allocations to international and emerging market equities because of our strong belief that they are integral asset classes in a well-diversified portfolio. This discipline is beginning to pay off, and we believe there are tangible reasons to be hopeful that continued positive returns can be derived from these markets, as valuations remain supportive, if not outright attractive, in certain areas.

Finally, September is National Life Insurance Awareness Month. Please get in touch with us if you would like to review your current policies to ensure you have appropriate insurance coverage. Life insurance can be an integral part of a holistic financial plan. Gill Capital Partners is a full service firm and can assist with all of your planning needs.

As always, please let us know if you have any question or concerns, or if we can provide assistance with any other financial planning matters including education, taxes, insurance or estate needs.