Q4 2012 Financial Market Commentary and Economic Update

The Economy

Economic activity in the fourth quarter was mixed, with certain segments showing modest improvement while others exhibited stagnation or slight declines. With the situation in the Eurozone, previously a major negative on the global economy, slowly healing, the focus in the fourth quarter turned to modestly improving economic data and the impending fiscal cliff impasse. Globally, in addition to continued recovery in Europe which resulted in plummeting yields on Greece’s sovereign debt, China’s economy also showed signs of emerging from the slowdown that had plagued it for the previous several quarters. Domestically, the fourth quarter brought further good news on the housing front. Many measures of the housing market remained in an upward trend, boosting consumer confidence. Manufacturing continued to be problematic for the economy during the quarter, with Hurricane Sandy affecting output, particularly in the Northeast.

U.S. employment stabilized somewhat during the quarter but was still below the level required to reduce the unemployment rate materially. Lackluster growth in payrolls is of such concern to the Federal Open Market Committee (FOMC) and Chairman Ben Bernanke that the FOMC has explicitly targeted a reduction in the unemployment rate as part of its monetary policy. The FOMC stated after its December meeting that it would maintain its current low interest rate policy until the unemployment rate declines to 6.5%, as long as inflation remains below 2.5%.  Many analysts believe that employment will continue to grow only modestly for at least the first half of the year as businesses remain reluctant to add to staff without a better understanding of the fiscal and regulatory climate they face.

Many analysts believe that employment will continue to grow only modestly for at least the first half of the year as businesses remain reluctant to add to staff without a better understanding of the fiscal and regulatory climate they face.

Europe’s economic problems were only a minor factor in the fourth quarter thanks to a moderate improvement in the fiscal outlook for the region. The European Central Bank (ECB) adopted a much more aggressive posture in the third quarter, with ECB President Mario Draghi stating that the central bank would do “whatever it takes” to support the euro currency and member nations. Market participants interpreted the new stance as the ECB’s willingness to backstop troubled nations’ sovereign issues, and yields on those securities continued to react very favorably. For example, the yield on Greece’s 10-year sovereign debt declined from 19.23% at the end of the third quarter to 11.69% as of December 31, 2012.

Because of the difficulties faced by the economy in general and employment in particular, the Fed took further aggressive action during the fourth quarter. It announced it would buy $45 billion in Treasury securities each month and maintain low interest rates until certain economic conditions are met. The Treasury’s purchases are in addition to the $40 billion in mortgage-backed securities the Fed is already buying each month and represents a further expansion of its already bloated balance sheet.

Highlights and Perspectives

GDP

The Bureau of Economic Analysis released the third estimate of the third quarter 2012 real GDP, giving it a seasonally adjusted annualized growth rate of 3.1%, the fastest of the year. It was also an upward revision from each of the prior two readings for the third quarter, the advance estimate of 2% and the second estimate of 2.7%. Including the results from the third quarter, GDP grew 2.6% over the prior 12 months. Personal income grew only 2.2% during the same period. The strength in the third quarter was the result of a number of factors, including: the Eurozone crisis’ retreat from the headlines, continued improvement in the housing sector, the largest positive contribution to growth from the government sector in three years, and robust non-farm inventory investment during the quarter. Corporate profits rose 2.4% from the second quarter to the third, but fell below economists’ expectations of 3.5% growth. Profit growth expanded 7.5% over the prior 12 months, but the growth was due exclusively to the results of financial firms. Profit growth in all other industries was stagnant. The consensus among economists is that growth will continue to hover around a 2% annualized rate for much of 2013.

HOUSING

The housing segment continued its turnaround in the fourth quarter, with several indicators posting material gains. Existing-home sales for November (the latest monthly data available) advanced at an annualized rate of 5.02 million units, the highest level in three years. The November results are 14.5% higher than a year ago. Hurricane Sandy negatively impacted sales in the affected region, but other areas of the Northeast made up for the setback. Existing-home prices also continued to rise, gaining 2% from October to November and 10.1% in the past 12 months. In addition, the months of available supply declined to 4.8 in November, the lowest level since 2005. In the new-home segment, the NAHB Housing Market Index, a measure of homebuilding activity, rose in December to its highest level since April 2006, reflecting improving homebuilder confidence. Driving the turnaround have been historically low interest rates and stabilizing job growth, which have combined to help support consumer confidence. Despite the recent gains and decidedly positive trend, however, analysts cite several risk factors heading into 2013, including a decline in disposable income and continued difficulty for potential homebuyers to obtain mortgage financing. Nevertheless, many economists believe that by the second half of 2013 job growth, wage income and demand will begin to accelerate, setting the stage for further recovery in housing.

EMPLOYMENT

The employment situation continued to improve modestly during the fourth quarter and remained a primary focus of monetary authorities in setting policy. The November payroll report, the latest available, showed a gain of 146,000 jobs despite the effects of Hurricane Sandy, outpacing the consensus expectations of a gain of 100,000. However, the gains from the previous two months were revised downward by a total of 49,000, owing primarily to revisions to government employment data. The unemployment rate, which had been expected to rise in November, actually declined to 7.7% from 7.9% the previous month. The Federal Reserve has openly stated that it will directly tie monetary policy to certain economic conditions, one of which is an improvement in the unemployment rate. Many economists believe that the employment gains experienced in the fourth quarter will be more difficult to replicate over the next few quarters due to ongoing uncertainty surrounding the fiscal situation, regulatory environment and tax policies. Businesses have scaled back on layoffs in recent quarters, but significant new hiring is unlikely to take place until greater clarity is achieved on both the fiscal and regulatory fronts.

FED POLICY

In an effort to both communicate with greater clarity to the markets and be more responsive to current economic conditions, the Federal Open Market Committee (FOMC) made a material change in its communication plan at its December meeting. Instead of tying interest rate policy to a calendar range, as it has done for many quarters, the FOMC announced it will target economic conditions going forward, theoretically enabling the markets to better develop expectations for future policy direction. The FOMC also announced that it would purchase $45 billion per month in Treasury securities, a program designed to replace the expiring Operation Twist. Combined with ongoing purchases of mortgage-backed securities (MBS), the Fed will buy approximately $85 billion of securities per month into 2013 and will be expanding its balance sheet toward $4 trillion. As part of its announcement, the FOMC said that the current low interest rate policy would remain in place until unemployment reaches 6.5% and inflation between one and two years out stays below 2.5%. The inflation component of the policy surprised many analysts, as the Fed’s assumed previous inflation target had been 2%. The higher threshold implies that the Fed is comfortable with the economy taking on somewhat higher inflation in order to combat unemployment. While many economists agree that targeting economic conditions rather than a calendar date is an improvement, one of the risks in such a move is that the Fed must communicate that rates won’t automatically rise once the thresholds are violated – there will be other factors affecting the timing and extent of any rate increase. The effect of the change means that economists – and the markets – can now better gauge the likely time at which the Fed will raise the fed funds rate, which remains at a target of 0%-0.25%. Some analysts estimate that conditions resulting in an increase are not likely to occur until early 2015. There also seems to be a consensus that since each of the Fed’s previously announced programs have had diminishing returns to economic activity and asset price growth, the latest announcement will have little impact on economic growth in the first half of 2013.

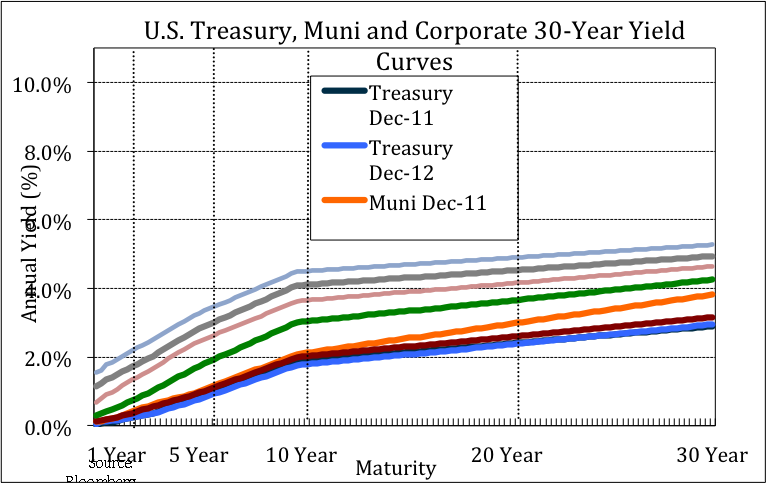

INTEREST RATES

The environment for fixed-income securities in the fourth quarter was similar to that of the third, with mixed economic data and continued improvement in the eurozone fiscal situation. However, there were two additional factors serving as cross-currents during the quarter: (1) the Fed’s announcement that it would begin to target economic conditions in setting monetary policy and (2) the looming fiscal cliff situation. The backdrop of these factors resulted in a continued low interest rate environment. The yield on the benchmark 10-year U.S. Treasury rose to 1.76% as of December 31, 2012 from 1.64% on September 28, 2012. Even though the yield rose slightly for the quarter, it still represented the lowest year-end closing yield on record. The yield on the 30-year U.S. Treasury also rose to 2.95% at the end of the fourth quarter from 2.83% at the end of the third.

As with previous quarters, perhaps the primary driving factor in the fourth was the Fed’s continued aggressive monetary policy. At the end of the third quarter the Fed initiated its third program of quantitative easing, or “QE3”. The announcement had little impact on the markets in the fourth quarter, and each successive Fed program has had diminishing returns in terms of effectiveness. The Fed left little doubt that it is in the process of waging an all-out campaign to support the economy and boost employment, as it announced at its December meeting that it would replace the expiring Operation Twist program with outright purchases of $45 billion in Treasury securities. These purchases are in addition to the $40 billion in mortgage-backed securities being bought each month and amount to a further increase in the Fed’s balance sheet, which is now approaching approximately $4 trillion.

With this environment as a backdrop, yields were generally higher, particularly further out on the yield curve. The yield on the 3-month T-bill declined to 0.04% at the end of the fourth quarter from 0.09% the previous quarter. The yield on the five-year Treasury rose to 0.72% on December 31, 2012 from 0.63% on September 30, 2012, and as mentioned above, the yield on the 10-year Treasury rose to 1.76% from 1.63% over the same period. As with the previous quarter, inflation expectations also rose modestly, with the Fed’s gauge of five-year forward inflation expectations increasing to 2.78% on December 31, 2012 from 2.68% on September 30, 2012.

With the Eurozone situation becoming less of a concern and a dovish Fed monetary policy, yields on credit securities fell during the quarter. The yield on the Barclays 1-3 Year Credit Index fell to 0.97% from 1.01% during the quarter. Intermediate credit yields also declined, with the yield on the Barclays 7-10 Year Credit Index falling to 2.93% on December 31, 2012 from 3.02% on September 30, 2012. Yields on high-yield securities fell significantly in the more “risk-on” environment of the fourth quarter, declining to 6.79% from 7.19% at the end of the third quarter. Municipal bond yields were generally little changed after declining for several quarters. The yield on the Barclays Municipal Bond index was unchanged at the end of the quarter at 2.17%.

EQUITIES

Stocks were buffeted by various cross-currents during the quarter, with a lackluster employment environment and the uncertainty surrounding the fiscal cliff situation vying with an aggressive Fed posture and an improved Eurozone outlook. The tug-of-war resulted in a moderate amount of volatility, particularly after the election when investors determined that President Obama’s margin of victory meant that tax rates would likely rise. The S&P 500 Stock Index posted a -0.38% total return for the quarter. For the entire year the S&P 500 gained +16.00%. In terms of the S&P Global Investment Classification Standard (GICS) sector performance, financials led the way in the fourth quarter and for the entire year, posting +5.92% and +28.82% gains, respectively, based on the S&P 500 Index. Telecom services and  information technology were the worst performing sectors for the quarter, declining -6.02% and -5.72%, respectively, based on the S&P 500 Index.

information technology were the worst performing sectors for the quarter, declining -6.02% and -5.72%, respectively, based on the S&P 500 Index.

For the quarter, the Russell 1000 Index of large capitalization stocks posted a +0.12% total return. For the year, the index was up +16.42%. Small capitalization stocks, as represented by the Russell 2000 Index, also gained ground, ending with a total return of +1.85%. For the full year, the index advanced +16.35%. In a continuation of the pattern of the previous two quarters, value stocks materially outperformed growth-oriented issues. The Nasdaq Composite, dominated by information technology stocks, generated a return of -2.65% during the quarter.

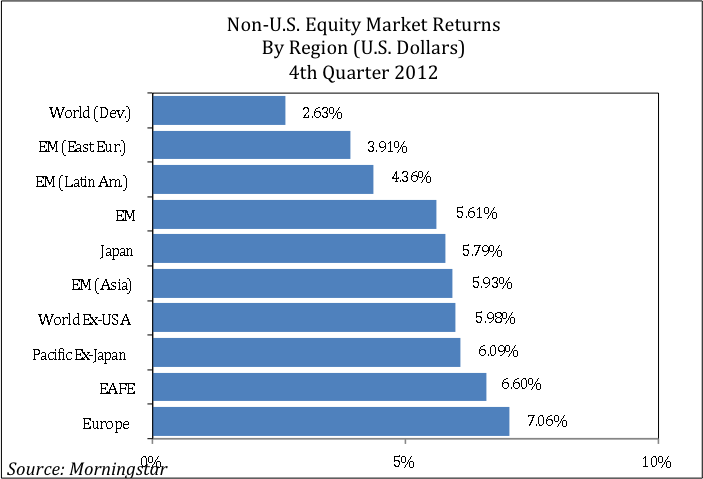

In a turnaround from the situation prevailing over the past several quarters, international stocks outperformed domestic U.S. equities during the quarter. The MSCI EAFE Index of developed markets stocks rose +6.60% during the three months ended December 31, 2012. For the year, the EAFE Index advanced +17.90%. Emerging markets stocks also posted gains during the quarter, with

the MSCI Emerging Markets Index generating a return of +5.61%. For the full year, the MSCI Emerging Markets Index was up +18.63%.

Outlook

Looking ahead to the first quarter of 2013, all eyes will be on how the fiscal cliff and the debt ceiling will be resolved and how the markets react to ongoing negotiations. Based on the deal struck by Senate Republicans and the White House on December 31, 2012, the revenue side of the equation will take the form of tax increases for certain income levels. However, no agreement has been made

regarding the sequestration, or automatic spending cuts that by law are now set to take place. Congress will likely buy itself some time to negotiate a longer-term solution that perhaps also encompasses entitlement reform. The other main element of importance in the first quarter is the need to raise the debt ceiling. The Treasury has already exceeded the current borrowing threshold, and a debt ceiling increase must occur within the first couple of months of the new year. As with the negotiations in the summer of 2011 there should be a significant amount of wrangling between the various factions, with conservative Republicans attempting to obtain spending reductions in return for the increase in the debt ceiling.

Many economists believe that the fiscal issues will continue to serve as a drag on the economy for the first half of 2013, but that acceleration in growth could occur in the latter half of the year. By that time, businesses should have greater clarity on the regulatory and fiscal outlook and will be able to plan and invest with confidence. On balance, corporate financial statements are in excellent condition as a result of cost cutting and increased productivity since the Great Recession. In addition, corporate profit margins, in general, are near a record high level, but in order to maintain healthy earnings businesses must identify new growth opportunities in which to invest.

Assuming lawmakers can reach some sort of resolution on the fiscal cliff – even if it means a short-term patch followed by more meaningful reform of the tax code and entitlements – equities should be poised to fare well. Valuations remain very reasonable on a historical basis, and investors will increasingly be seeking alternatives to fixed-income securities, which are in a trading range near record low yields.

Disclaimer:

The information, analysis, and opinions expressed herein are for general and educational purposes only. Nothing contained in this quarterly review is intended to constitute legal, tax, accounting, securities, or investment advice, nor an opinion regarding the appropriateness of any investment, nor a solicitation of any type. All investments carry a certain risk, and there is no assurance that an investment will provide positive performance over any period of time. An investor may experience loss of principal. Investment decisions should always be made based on the investor’s specific financial needs and objectives, goals, time horizon, and risk tolerance. The asset classes and/or investment strategies described may not be suitable for all investors and investors should consult with an investment advisor to determine the appropriate investment strategy. Past performance is not indicative of future results.

Information obtained from third party sources are believed to be reliable but not guaranteed. Gill Capital Partners makes no representation regarding the accuracy or completeness of information provided herein. All opinions and views constitute our judgments as of the date of writing and are subject to change at any time without notice.