Pulse Points > December Investments & Market Update

Gill Capital Partners December 2017 Market Commentary

First and foremost, we would like to wish all of our clients, friends, and partners Happy Holidays and Merry Christmas. We are thankful for the privilege of working with each and every one of you.

__________________

Bitcoin & Crypto-Currencies

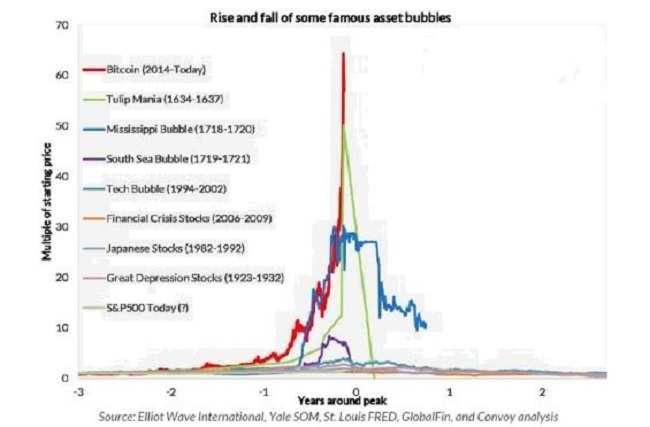

News surrounding the meteoric rise of the price of Bitcoin and other crypto-currencies has begun to dominate the headlines as the price of Bitcoin has surged. As of this writing, Bitcoin is up 1,483% year to date, although down 25% from its all-time high printed just four days ago. In historical terms, this is the greatest asset price spike in the history of the world, even surpassing the infamous Dutch “Tulip Mania” of the 1600s. We will discuss the bubble-like nature below, but for now we just want to experience a moment of true Zen and recognize the fact that we are all witness to an asset price move the likes of which has never before been seen in recorded history. Many economic historians draw comparisons between Bitcoin and the Dutch Tulip mania, the dot-com bubble of the late 90s, or the Japanese stock market in the 1980s, all of which now pale in comparison to what we are seeing with Bitcoin, as can be seen in the chart below.

Tulip mania is the closest to the Bitcoin bubble in terms of scale. In case you do not recall, tulip mania was a period in the 1600s in Holland where cash-based futures were introduced on tulip bulbs, which had become increasingly fashionable and popular. Tulip prices proceeded to reach extraordinarily high levels as elites and nobles used them as status symbols. In 1623, tulip bulbs were selling for around 1,000 Dutch Gilders, while the average annual income in the country was 150 Gilders. Tulip mania collapsed in an equally dramatic fashion as tulip prices were eviscerated, and until this day is still thought of as the first recorded speculative bubble. The headlines are now full of talk surrounding Bitcoin and people are wondering if Bitcoin is another speculative bubble. Will the right side of the chart mirror the left, like other speculative asset bubbles have? Is Bitcoin a good investment?

Our View:

Blockchain technology, which is the basis behind crypto-currencies, is a transformative technology and is likely to disrupt the finance industry at some point. However, it is still in its very early stages, and until it matures, its price appreciation is likely only speculation. This is not dissimilar to the mainstream adoption of the internet in the 1990’s which was also transformative. Many e-commerce businesses were completely wiped out during the dot-com crash, only to be replaced by businesses like Amazon, and it took Amazon decades to develop, grow, and scale their business into the success it is today. Until the crypto-currency model matures, scales, and is adopted in a more widespread fashion, it is speculation, not an investment.

Tax Reform Update

Congress passed the new tax bill on December 20th, and Donald Trump will shortly sign it into law. Most of the bill’s provisions will take effect as of Jan 1, 2018, so the tax community will have its hands full trying to get ready for the forthcoming tax season. Below are the highlights of the new legislation:

- New individual rates: The bill has seven individual brackets: 10%, 12%, 22%, 24%, 32%, 35%, and 37%. The new 37% bracket would apply to taxable income in excess of $500,000 for individuals and $600,000 for those filing jointly.

- Increased standard deduction: The standard deduction will increase to $12,000 for single filers and $24,000 for those filing jointly.

- Child tax credit: Will be increased to $2,000 per child from $1,000 per child.

- AMT: The AMT was not eliminated, but the exemption is significantly higher.

- Mortgage interest deduction: Individuals will be able to deduct the interest paid on new mortgages up to $750,000, down from the current cap of $1 million.

- State & local tax deductions: Taxpayers will be allowed to deduct up to $10,000 of their state and local taxes.

- Expiration of tax provisions: Most of the new provisions are set to expire in 2025; if not extended at that time they will revert to 2017 levels.

- Repeal of the individual mandate: The bill repeals the individual mandate to purchase health insurance (beginning in 2019).

- Corporate Taxes: Corporations would be taxed at 21% beginning in 2018, down from 35% currently.

- Taxes on pass-through businesses: Pass-through businesses such as S-Corporations, LLC’s, sole proprietorships and partnerships would be allowed to deduct 20% of their income; there are other special rules that apply to certain types of businesses.

- 529 Expansion: Up to $10,000 per year of money in a 529 college savings plan can be used to pay for K-12 tuition.

Our View:

The market has largely priced in this tax plan as evidenced by the market’s ho-hum reaction immediately following its passage. Corporations are the clear winners of this new tax legislation, and the lower tax rates will help justify current P/E ratios. The impact of this legislation will be different for everybody, so we can’t make any sweeping statements about how it will impact individual taxpayers. Now is good time to reach out to your tax advisor and understand how the upcoming changes will impact your particular situation.

Gill Capital Partners 2017 Toy Drive

Our 1st Annual Gill Capital Partners Toy Drive was a huge success! Thank you for helping us Give Back to our community and making over 10,000 Denver children happier this Christmas. We delivered approximately 100 toys to the Denver Santa Claus Shop and spent the afternoon stocking shelves and helping families in need pick out a toy to place under the tree this year. We try to be very thoughtful of how we spend our time and money – both as a company and as individuals and strongly believe in supporting the needs of our community through service and financial support. Thank you for making our 1st Toy Drive a huge success!

As always, please let us know if you have any question or concerns, or if we can provide assistance with any other financial planning matters including education, taxes, insurance or estate needs.