Pulse Points > January Investments & Market Update:

Gill Capital Partners January 2018 Market Commentary

“Learn every day, but especially from the experiences of others. It’s cheaper!” – John Bogle

Q4 & 2017 Market Review

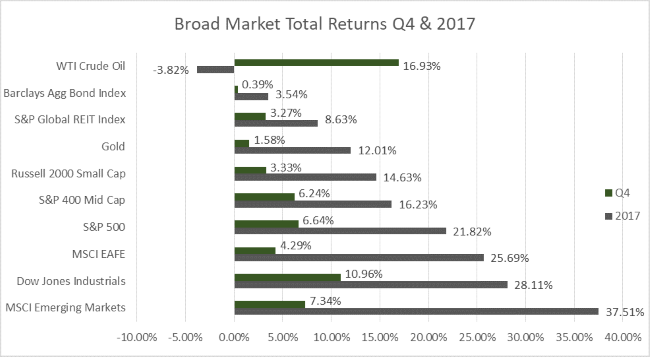

Looking back on 2017, it was truly an astonishing year in so many ways. The fourth quarter saw a further continuation of the uptrend in global equities, with all major equity indices positive for the fourth quarter, and up significantly for the year. As shown in the chart below, the S&P 500 index was up just over 6% in the fourth quarter, and ended the year up just over 20% on a total return basis (which includes dividends). Global stocks outperformed U.S. stocks with the MSCI emerging market index up just over 7% for the quarter and up nearly 38% for the year. Fixed income ended up modestly in 2017 with the Barclays U.S. Aggregate Bond Index up 3.5% for the year on a total return basis. Investors were certainly rewarded for taking risk in 2017, and we are pleased to report that our investors participated in the gains as asset allocation provided access to growth while containing risk. Many investors are surprised at how well the markets performed against the backdrop of so many shocking and negative headlines. Those who were able to maintain their investment discipline, diversification, and asset allocation were rewarded for it in 2017.

Looking Ahead

While we do not know what the next year will bring, we work to learn from the past, and recent history has taught us to focus less on headlines and more on fundamentals. In doing so, we can say that we remain cautiously optimistic. As shown below, global economic fundamentals are strong and improving with expansion firmly in place across the globe:

- Corporate profitability continue to impress, and projections are rapidly improving as the new tax cuts have created a new tail wind for U.S. corporations.

- The Federal Reserve has been methodical in its approach to increasing interest rates thus far, and we see that continuing. Interest rates remain low on a relative and nominal basis and are still not high enough to be competitive with stock prices.

- Unemployment remains at historically low levels; wages have not picked up substantially, but is something we are watching closely.

- Inflation remains unusually persistently low, and is allowing the Federal Reserve to be conservative as they raise rates.

- Valuations are high, but not extremely so, and with corporate profits increasing, high valuations can be further supported.

While we are optimistic with respect to economic fundamentals, we are cognizant of where we are in the growth cycle and some of the risks that exist. Below are a few areas we continue to watch that could pose threats to the current expansionary cycle:

- Geo-Political Risk – Various geo-political risks have been intensifying over the past year; so far, this has not disturbed fundamental economic growth but has the potential to do so.

- Commodity Spike – Recessionary environments are often preceded by commodity price spikes. Commodity prices are not currently anywhere near “spike” levels, but we have seen a quiet increase in oil prices from $25 per barrel to near $65 per barrel.

- Aggressive Federal Reserve Policy – Aggressive interest rate hikes by previous Federal Reserve regimes has led to recession in the past. The Federal Reserve is not raising interest rates “aggressively” at this time; however, if inflation begins to pick up and the Fed becomes more aggressive with interest rates, this could pose a more significant risk.

- Yield Curve Flattening - An inverted yield curve has been one of the best indicators of a forthcoming recession. While the yield curve is not inverted, it has been steadily flattening over the past year.

Though there is no shortage of risks to keep an eye on, none are currently pointing to a recession. Each of the past 10 bear markets (defined as a decline of 20% or more) were accompanied by at least one of the following: a commodity price spike, an aggressive Federal Reserve, or extreme valuations. Today, not one of these are present. This is not to say that a correction is not coming, but these historical indicators are not in play currently.

Save The Date – Lunch and Learn – Update on the New Tax Plan - With Jeff Rattiner, CPA, CFP®

Please join us for lunch at the Denver Country Club on Monday, February 26th from 11:30am to 1:30pm for a very informative discussion on the new tax plan and how to prepare for it. Mr. Jeff Rattiner is a nationally recognized speaker in the financial services industry, with expertise in tax planning and strategy. Jeff holds the designations of CPA and CFP®, and has been teaching and practicing in the financial services community for 30 years. He was named the “Financial Planner of the Year” by CPA Magazine in 2003 and has been awarded the “Distinguished Faculty Member-Teacher of the Year” by the Community College of Denver.

Please join us for lunch at the Denver Country Club on Monday, February 26th from 11:30am to 1:30pm for a very informative discussion on the new tax plan and how to prepare for it. Mr. Jeff Rattiner is a nationally recognized speaker in the financial services industry, with expertise in tax planning and strategy. Jeff holds the designations of CPA and CFP®, and has been teaching and practicing in the financial services community for 30 years. He was named the “Financial Planner of the Year” by CPA Magazine in 2003 and has been awarded the “Distinguished Faculty Member-Teacher of the Year” by the Community College of Denver.

Mr. Rattiner has authored eight books on financial planning subject matter (including tax), and is a leading authority and sought-after speaker in the industry. Jeff’s lively and entertaining teaching style has served professionals well for 30 years and will be sure to keep you entertained as he discusses the new tax plan and how it will impact you in 2018.

We hope you will be able to join us for this unique event. A formal invitation is on its way.

As always, please let us know if you have any question or concerns, or if we can provide assistance with any other financial planning matters including education, taxes, insurance or estate needs.