PulsePoints > June Investments & Market Update

June Investment & Market Commentary

"An investment in knowledge pays the best interest." - Benjamin Franklin

Market Update

As we move into summer, the markets are generally displaying a welcome sense of calm following the volatility we experienced earlier in the year. As of this writing, most major U.S. equity indices are in positive territory for the year, with the S&P 500 up just over 2% for the year and small and mid-cap stocks up just over 3%. International equities are down approximately 3.5% for the year, and emerging market equities are up nearly 2% after being down 15% earlier in the year.

Bonds are beating stocks from a return perspective, which has taken many by surprise. Oil is hovering just below $50/barrel, up 30% for the year after touching $25/barrel in February, as the supply and demand fundamentals have shown signs of correcting their imbalances. Below are a few topics that our Investment Committee has been discussing recently.

Interest Rates & the Federal Reserve

Following a weaker-than-anticipated monthly jobs report on Friday, which showed that fewer jobs were added than expected, market expectations for a rate hike have adjusted accordingly. The market is now factoring in a 29% probability that the Federal Reserve will raise interest rates 25 basis points in July and a 41% chance they will raise rates by mid-September of this year, down from 52% and 60% respectively prior to the release of the labor report. As markets have stabilized over the past few months, the Federal Reserve has been telegraphing forthcoming rate increases aimed at setting expectations and gauging market reactions.

Our view:

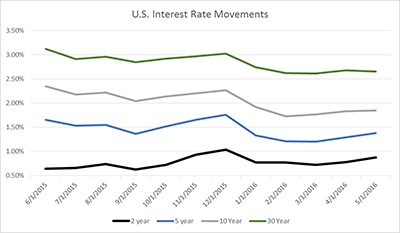

We are assuming the Federal Reserve is not too excited about Friday’s labor market report, as it will likely push out the tightening they have been attempting to prepare the markets for (barring a series of stronger economic reports in the coming months.) However, we spend less time analyzing what the Fed is doing and saying and more time watching the movement of the bond market. The chart below of U.S. Treasury rates shows an interesting, yet not unexpected, phenomenon. As the expectation for interest rate hikes has increased, short term rates have moved higher, but intermediate and long term rates have actually moved lower. This is commonly referred to as “yield curve flattening.” Surprisingly enough, although somewhat counterintuitive, this is a rather common occurrence during tightening cycles. We believe that this cycle is being further influenced by the extremely low global interest rate environment, which makes our interest rates attractive to foreign buyers. As foreign buyers purchase longer dated U.S. Treasuries, it puts downward pressure on rates.

This interest environment is one we have been anticipating and planning for. Remember, bond prices move inversely to interest rates (rates up = bond prices down), so as intermediate and long-term bond yields have moved lower, bond prices have moved higher, in some cases significantly so. This movement has led to an environment where bonds (aside from short term bonds) are outperforming stocks, and many advisors who have been putting their clients into short term bonds are left scratching their heads.

Trouble with Retailers

Conventional “brick and mortar” retailers such as Nordstrom, Macy’s and other big department stores are feeling the pressure from the unrelenting consumer shift to e-commerce. Noticeable and consistent declines in foot traffic and sales are driving a massive shift in the industry. E-commerce sites like Amazon, Priceline, and Ebay have been the beneficiaries. As shown in the chart below, Amazon (white line), is at an all-time high, up nearly 70% over the past year, while Nordstrom and Macy’s are down nearly 50% over that same time frame.

Our view:

We don’t view this as a blip, but rather a fundamental shift in the way people buy goods. All of the large physical retailers also have online retailing, but at the corporate level they are significantly disadvantaged due to their higher operating expense related to their physical retail locations. Not only is this impacting the stock price of these old school retailers, but the value of the real estate beneath them. We are watching closely as real estate values will likely be the next shoe to drop, as more and more stores shutter their doors.

As always, please let us know if you have any question or concerns, or if we can provide assistance with any other financial planning matters including education, taxes, insurance or estate needs.