PulsePoints > March Investment & Market Update

What a Difference One Month Makes

“Buy, buy, buy. Oh, everyone’s buying? Then sell, sell, sell.”

Rodney Dangerfield - Caddyshack

Market Update

One month ago, global equity markets were down between 10% and 15% for the year and bond yields had dropped precipitously in a vicious global flight to quality. In our last piece, “Keep Both Hands on the Wheel,” we discussed the drivers of this volatility: $25 oil, credit issues stemming from the commodity crash, weaker corporate earnings growth, issues in China, and the realization of how all of these factors impact global monetary policy. What a difference a month makes! Have the world and the markets changed materially in one month’s time? Below is a brief overview of major topics we are discussing within our investment committee.

Recent Market Rally

Most equity markets have rallied significantly since the middle of February and now sit very close to the breakeven line for the year. The equity market rally has followed oil’s lead, which rallied to nearly $40/barrel recently after falling to roughly $25/barrel in mid-February. The chart below shows the S&P 500 (white line) and the price of WTI Crude Oil (yellow line) since the beginning of the year. The correlation is stunning, and you can clearly see the level to which oil is dominating this market.

So, is this the beginning of a new equity rally, or just an oversold bounce in the markets?

Our view:

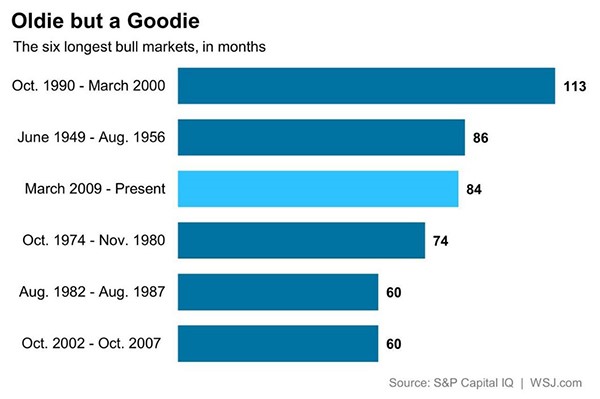

As long-term investors, we strive to look past the weekly and monthly gyrations of the market. That being said, our investment committee is aware of where we are in the market in terms of valuations and maturity (see chart below).

Despite the rally over the past month, we believe that this is not the time to take undue risk or overweight risk within portfolios, but to remain disciplined and maintain proper asset allocation. From a macro perspective, we are a bit more cautious now than we were a few months ago for the following reasons:

Despite the rally over the past month, we believe that this is not the time to take undue risk or overweight risk within portfolios, but to remain disciplined and maintain proper asset allocation. From a macro perspective, we are a bit more cautious now than we were a few months ago for the following reasons:

Valuations – While equity valuations are not absurd, they are also not overly appealing. Depending upon what metric you look at, U.S. equity valuations (based on P/E ratio) are modestly above their long-term averages. Certain international equity markets appear more reasonably valued, and in some cases undervalued.

Credit concerns – We continue to have concerns related to credit, particularly high-yield credit, based largely on the collapse in commodities. While the recent oil rally has been a positive sign, oil realistically needs to move north of $45 or $50 to have a materially positive impact on the oil producers that are still bleeding money today.

Political risk – The tone of the 2016 U.S. presidential election is clearly a backlash against the establishment on both sides. Markets like certainty and clarity, and to the extent that this election cycle will continue to introduce uncertainty and negative news headlines, then the introduction of political risk into the equation will only add to market volatility and create further headwinds.

That said, we know that long-term investors are rewarded, and there are reasons to be optimistic:

Employment growth – Employment growth has been steady and robust, which will continue to be a tail-wind for consumer spending.

Real estate – Both commercial and residential real estate markets continue to show strength.

Accommodative central banks – Central banks continue to provide fuel for capital markets, particularly in Europe and Japan, where central banks are injecting unprecedented liquidity in an effort to drive growth and inflation higher.

Summary

We believe this is a good time for portfolio “housekeeping,” to make sure allocations are appropriate and well-implemented. We have been dedicating significant resources to this effort on your behalf. We have made some portfolio moves at the allocation and manager level, and are in the process of assessing further adjustments, which you may see inside your portfolio in the coming weeks.

If you find this piece helpful, please forward it to others who may be concerned with the recent market environment or may be struggling for answers. As always, please let us know if you have any questions or concerns, or if we can provide assistance with any other financial planning matters including education, taxes, insurance, or estate needs.