The Daily Difference: Keep Both Hands on the Wheel

Market Update The financial markets just completed one of the worst Januarys on record, and the risk aversion and indiscriminant selling have so far continued into February. As of this writing, equities globally are down about 10% for the year, and many investors are left scratching their heads. Below is a brief summary of a few key topics and what our view is here at Gill Capital Partners. Especially during times like these, we feel it is important to make our clients aware of current events, both good and bad, along with our corresponding outlook.

On Credit Markets and Credit Cycles

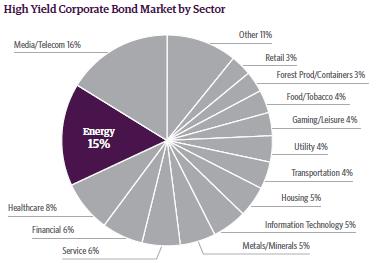

As expectations for oil prices and global growth have continued to ratchet down, concerns within credit markets are deepening. As shown in in the graph below, courtesy of our partners at Guggenheim Investments, energy related names now constitute roughly 15% of the high yield bond market. This is almost double the historical average of about 7%, as energy producers took advantage of relatively cheap debt to grow their businesses in recent years. As oil has continued to fall, the pressure is mounting on these businesses to be able to make their debt service payments.

With oil now hovering under $30/barrel, the market is anticipating defaults coming from this segment of the credit market. This concern is not a new one. The new concern is understanding to what extent the distress emanating from the energy names will spill over into non-energy related credit and whether it has the ability to materially impact economic growth.

Our view: As discussed many times over the past several months, we have been watching this issue closely. These same concerns led us to remove our allocation to high yield across portfolios early last year. Until recently, our research indicated that the issues within commodity-related credit would be contained, but the duration and severity of the drop in commodity prices has put even more pressure on these names than previously anticipated.

We are aware that often times the credit cycle leads the business cycle. A key lesson from the last crisis was that bursting asset price bubbles can create recessions. Our base case for this year was for commodity prices to stabilize and for the economy to continue to expand modestly, with the belief that strength in other parts of the economy would outweigh weakness coming from the commodities sector. However, the issues outlined above have raised our level of concern and may drive changes to our outlook in the coming weeks and months. The recent pressure on bank stocks and credit has caused us to evaluate the potential for “systemic” risk, and even though we have fewer concerns than the credit markets are currently pricing, these fears can become self-fulfilling. We are therefore approaching the current period with an extra sense of vigilance and caution.

Do we see the current issues in commodities and the credit markets flashing warning signs that a recession is near? Our Investment Committee does not yet subscribe to this view; instead our position, with considerable input from our research partners, is that the global economy, will avoid a near-term recession and instead experience a slowdown in growth. We do not expect an outright recession or a repeat of 2008-2009. We do not see the same risks with valuations, leverage and other fundamental issues that hit the heart of the consumer and the economy back then. Rather, we view this as more of a “garden variety” credit cycle, one that can still coexist with more of the same subpar growth we have seen economically for the past few years. We are likely however, to see episodes of heightened volatility (like we are seeing now), and indiscriminant selling, which will ultimately lead to value creation and opportunity. We are becoming more cautious, however, and don’t rule out the possibility of a credit cycle that could lead to more widespread issues than are currently anticipated.

On The Federal Reserve, Interest Rates and Currencies

How quickly things change. Just over a month ago, the markets were anticipating 3 to 4 rate hikes in 2016. The dollar had strengthened significantly on the back of these assumptions, and interest rates were beginning to move higher in anticipation of a tightening Federal Reserve, higher future inflation, and a stronger economy. Fast forward one month, and continued concerns over commodities, China, and credit have led market expectations to remove nearly all probability of the Federal Reserve increasing rates this year (with some analysts calling for more easing). This has led to a swift revaluation of assets across many financial markets. Interest rates have fallen sharply to the lowest levels since 2011-12 (the U.S. 10-year has fallen roughly 70 basis points from 2.3% to 1.6%). Equities have declined roughly 10%, and the U.S. dollar has weakened dramatically.

Our view: Our expectations for rate increases were always more subdued than the market expectations; our portfolios, particularly our fixed income portfolios were built with this in mind. Our base scenario called for 1-2 interest rate hikes by the Federal Reserve in 2016. It does appear to us that certain aspects of the credit markets are pricing based upon worst outcomes at the moment, leading to what appears to be a complete disregard for fundamental economic strength in other areas. At this point, barring a significant disruption in the credit cycle, or a realization of systemic risk (as outlined above), we would anticipate the markets to regain their footing and begin to stabilize and for the economy to realize a modest level of economic growth led by consumer strength and real estate. This will lead to a normalization within fixed income markets, a stronger dollar, and higher equity valuations.

Summary

While the above overview may sound overly negative, we do not believe that we need to be making wholesale changes within portfolios to remove risk in anticipation of a much larger move down as we saw in 2008-9. We have made some minor portfolio moves, mostly within our fixed income allocation, based on evolutions in the credit markets. We believe this is very different than 2008-9 and do not have the same level of concern. Rather, we are trying to alert you to the fact that we do see growing risks within parts of the global financial system, and we continue to diligently analyze our portfolio allocations to make sure we are optimally allocated and will continue to do so as the information evolves. Furthermore, it is beginning to appear that equity markets are significantly oversold at this point. Investor fear and pessimism are at levels that would indicate a near term bounce. Valuations are becoming increasingly more attractive, and in some cases may represent deep value opportunities for long term investors.

If you find this piece helpful, please forward it to others who may be concerned with the recent market environment or may be struggling for answers. It is times like these that so many advisors, especially those who are unprepared or poorly allocated, tend to disappear. As always, please let us know if you have any questions or concerns, or if we can provide assistance with any other financial planning matters including education, taxes, insurance, or estate needs.